A Survey of Law Professors on Tax Reform

As the Biden administration’s inaugural budget reaches the crucial final steps of the legislative process, a number of significant tax reforms are under consideration for the first time in years. The administration has appointed several tax law professors to help advise the effort.[1] But what does the tax academy in general think? What Biden administration reforms do the most tax law professors support, and which reforms would professors like to see which the administration has not yet proposed? To answer these questions, I surveyed American tax law professors on their opinions of fundamental tax law reforms.

I. Survey Methodology

The survey was sent to all American tax law professors listed in the Directory of Law Teachers published by the Association of American Law Schools.[2] 486 surveys were distributed, and 167 responses were received, giving a 34.4% response rate. The survey opened on July 7, 2021 and closed on July 16, 2021.

The format of the survey was simple: a single page with a series of potential federal tax reforms. The respondent was asked whether she supported the reforms, and for each could indicate “Yes,” “No,” or “Neutral / No Opinion.” The survey included 3 instructions:

- Please evaluate each option in isolation. For example, if you would most prefer wealth taxation, but feel that if wealth is not taxed then mark-to-market taxation is better than nothing, please indicate “Yes” for both.

- If you would agree with any variant of a given reform, please indicate “Yes.” For example, if you would specifically support repealing the work requirement of the Earned Income Tax Credit, please indicate “Yes” to expanding the Earned Income Tax Credit.

- Please assume that all reforms are relative to current law. For example, if you agree with the Biden administration’s proposal to increase the corporate tax rate, please indicate “Yes” for higher corporate tax rates.

These instructions tended to push respondents toward “Yes” answers; as a result, relative rates of support for particular reforms may be more informative than absolute rates. The reforms presented were generally issues that might appear in a basic federal income tax class. More specialized questions on topics like tax administration and international tax were excluded from the survey.

II. Survey Results

In addition to reporting percentages for “Yes,” “No,” and “Neutral / No Opinion,” I also calculated the percentage of “Yes” responses out of the total “Yes” and “No” responses (i.e., excluding “Neutral / No Opinion” responses).[3] These are listed in the “Yes if Opinion” column below, and the table is sorted in descending order of this percentage. The leftmost column reproduces the exact language used in the survey.

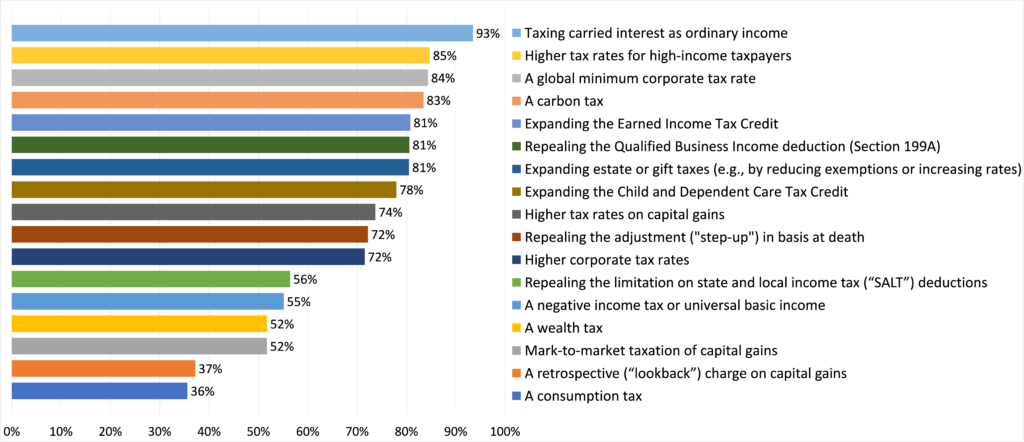

The following graph shows “Yes if Opinion” percentages, again in descending order.

Politically, reforms with a moderate liberal valence garnered the widest support among tax law professors. In fact, one of the most striking findings of the survey is how well the popularity rankings correspond with reforms that the Biden administration has actually endorsed.[4] In its budget proposals for the coming year, the administration has included treatment of carried interest as ordinary income,[5] higher taxes for the rich,[6] and a global minimum corporate tax,[7] among others.[8] Among the least popular reforms were some associated with law and economics (retrospective capital gains taxation,[9] the consumption tax[10])[11] and with the progressive wing of the Democratic party (the wealth tax[12]). The Biden administration has not proposed these less popular reforms, nor has it proposed mark-to-market taxation of capital gains, a universal basic income, or repealing limitations on SALT deductions.

On the other hand, the administration has also not proposed a few of the more popular reforms, including a carbon tax,[13] repealing the Qualified Business Income deduction, or expanding estate and gift taxes. Of course, final budgets often significantly depart from budget proposals, and even very popular reforms may ultimately be cut. Most notoriously, preferential treatment of carried interest has resisted repeated efforts at reform,[14] despite its unpopularity.[15]

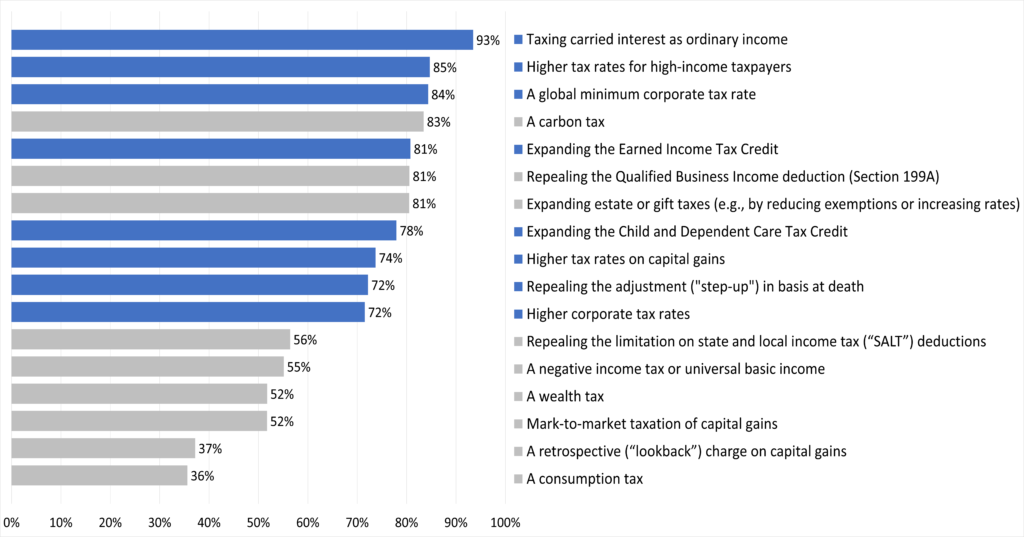

The following graph shows each of the reforms, again in descending order of “Yes if Opinion” percentages, with reforms included in the Biden administration’s 2022 “Green Book” of budget proposals[16] in blue, and the excluded reforms in grey.

We can also break down these aggregate results by the tenure status of faculty (as reported in the Directory of Law Teachers) and by gender.

55 of the respondents were female, and 112 were male. Female respondents were more positive about reform in general. Of those respondents who had an opinion, female respondents were on average 10.6% more likely to respond “Yes” compared to male respondents across all reforms.[17] Female respondents were especially more likely to support wealth taxes (29.5% more likely), negative income taxes / universal basic income (27.9% more likely), and repealing the limitation on SALT deductions (19.25% more likely). Male respondents were especially more likely to support consumption taxes (11.4% more likely) and a retrospective charge on capital gains (10.8% more likely).

134 of the respondents were tenured, and 33 were untenured. Tenured and untenured faculty did not substantially differ on average propensity to respond “Yes” across all the reforms, although they differed on some specific reforms. Among those respondents who had an opinion, tenured faculty were especially more likely to support wealth taxes (17.1% more likely). Untenured faculty were especially more likely to support expanding the Earned Income Tax Credit (18.2% more likely), a negative universal tax or basic income (17.7% more likely), and a carbon tax (16.4% more likely).

Overall response rates also differed by demographic group. Female professors were slightly more likely to respond to the survey than male professors (37.4% versus 32.9%), and tenured professors were more likely to respond than untenured professors (37.1% versus 26.2%). No other demographic data were collected; analyzing respondents by race, for example, would have been challenging given low numbers of non-white tax law professors.

Jonathan H. Choi is an Associate Professor at the University of Minnesota Law School, specializing in tax law, legislation and regulation, and computational analysis of law. Thanks to Kristin Hickman, Ariel Kleiman, and Zachary Liscow for their helpful feedback on survey design, and to all of the survey respondents for their participation.

[1] E.g., Professor Lily Batchelder Nominated to Senior Treasury Department Position, NYU L. (Mar. 11, 2021), https://www.law.nyu.edu/news/lily-batchelder-nomination-treasury-tax-policy; Clausing Joins Treasury Department as a Deputy Assistant Secretary, UCLA L. (Feb. 1, 2021), https://law.ucla.edu/news/clausing-joins-treasury-department-deputy-assistant-secretary; Itai Grinberg to Join Yellen’s Treasury Team, Bloomberg Tax (Feb. 1, 2021), https://news.bloombergtax.com/daily-tax-report/itai-grinberg-to-join-yellens-treasury-team; Professor David Kamin to Serve in Biden White House, NYU L. (Dec. 21, 2020), https://www.law.nyu.edu/news/david-kamin-biden-white-house; Fordham Law Professor Rebecca Kysar Joins Biden Administration, Fordham L. News (Feb. 3, 2021), https://news.law.fordham.edu/blog/2021/02/03/fordham-law-professor-rebecca-kysar-joins-biden-administration.

[2] Directory of Law Teachers, Ass’n of Am. L. Schs., https://www.aals.org/faculty-staff-resources/dlt (last visited Aug. 14, 2021).

[3] For clarity, I used the following formula: (Respondents indicating “Yes”) / (Respondents indicating “Yes”+ Respondents indicating “No”)

[4] However, the direction of causation is unclear. It may be that popular tax reforms among professors are perceived as the most legitimate or most likely to pass, and the Biden administration selected its proposals on this basis. Or, it may be that the Biden administration’s support for these reforms has raised their public profile and made them more popular among tax law professors. Or, tax law professors might generally support the Biden administration, and tend to support policies because they were proposed by the Biden administration, rather than on the policies’ own merits.

[5] Dep’t of Treasury, General Explanation of the Administration’s Fiscal Year 2022 Revenue Proposals 82-83 (2021).

[6] Id. at 60.

[7] Id. at 4-8.

[8] Id. at 70-72 (making permanent the expansion of the Earned Income Tax Credit passed in the American Rescue Plan of 2021); id. at 73-76 (making permanent changes to Child and Dependent Care Tax Credit passed in the American Rescue Plan of 2021); id. at 61-64 (taxing capital income of high-income taxpayers at ordinary rates); id. at 61-64 (repealing the step-up in basis at death for high-income taxpayers); id. at 3 (increasing corporate tax rates).

[9] Alan J. Auerbach, Retrospective Capital Gains Taxation, 81 Am. Econ. Rev. 167 (1991) (proposing retrospective capital gains taxation).

[10] Joseph Bankman & David A. Weisbach, The Superiority of an Ideal Consumption Tax over an Ideal Income Tax, 58 Stan. L. Rev. 1413 (2006) (arguing for consumption taxes, primarily from a law and economics perspective).

[11] On the other hand, carbon taxes are quite popular among economists and still polled relatively well. See George Akerlof et al., Opinion, Economists’ Statement on Carbon Dividends, Wall St. J., Jan. 16, 2019 (arguing for a carbon tax in an opinion piece signed by many high-profile economists).

[12] Most recently, a group of senators including Elizabeth Warren and Bernie Sanders introduced a bill taxing assets in excess of $50 million. Ultra-Millionaire Tax Act of 2021, S. 510, 117th Cong. (2021).

[13] In lieu of an explicit carbon tax, the current budget proposal eliminates fossil fuel tax preferences and provides a variety of clean energy incentives. Dep’t of Treasury, supra note 5, at 33-58. Although carbon taxes are a classic neoliberal policy, the Biden administration may have learned from the unpopularity of fuel taxes in other countries, like France. See Ben Hall, Harret Agnew & David Keohane, Macron Cancels Fuel Tax Increase After “Gilets Jaunes” Protests, Financial Times, Dec. 5, 2018.

[14] Alan Rappeport, Trump Promised to Kill Carried Interest. Lobbyists Kept It Alive, N.Y. Times, Dec. 22, 2017, at A14; Jenny Anderson & Andrew Ross Sorkin, Congress Weighs End to Private Equity Tax Break, N.Y. Times, June 21, 2007.

[15] Warren E. Buffett, Opinion, Stop Coddling the Super-Rich, N.Y. Times, Aug. 14, 2011, at A21.

[16] Dep’t of Treasury, supra note 5.

[17] The differences are percentage point differences, using the following formula: (Yes if Opinion among female respondents) – (Yes if Opinion among male respondents). These percentage point results were then averaged (unweighted) across all reforms to produce the 10.6% figure. An analogous formula was used for all of the demographic decomposition that follows. For ease of understanding by those without technical backgrounds, the results are denoted with “%” rather than “percentage points” or “pp.”