Repo in Turmoil: The Curious Case of the Missing Reserves, by Marcelo M. Prates

During the week of September 16, 2019, a little-noticed corner of the financial markets came under severe stress. In times of ultra-low interest rates, rates in the repo market spiked to nearly 10%. Repo, in this case, means “repurchase agreement,” a fairly safe lending operation, in which money is exchanged for highly-rated securities and exchanged back the very next day (or in a couple of days), with a premium—usually small because it’s a short-term, secured, and thus low-risk transaction.

The situation was so dire that the New York Fed, the operational arm of the Federal Reserve System, brought back open-market operations, providing the banking system with up to $100 billion of daily liquidity.[1] These operations, which the Fed had not used since the Global Financial Crisis in 2008, were seen as a bad sign. Some experts contended that another financial crisis was coming, others that the Fed’s operational framework was not working properly, and some claimed that post-crisis regulations were forcing banks to hoard reserves.[2]

In this post, I argue that the repo market’s jitters may reflect a sign of the changing nature of central-bank reserves, which might have been caused by well-intentioned prudential rules that have had unintended consequences.

Central-bank reserves as a monetary tool

Central-bank reserves, or simply reserves, are a type of money issued by central banks, much like banknotes and coins. But unlike cash, reserves are 100% digital and cannot be held or used by the public at large. Only banks can use reserves in their transactions with the central bank and other banks.

Since the origins of fractional-reserve banking, reserves have traditionally been used to control the multiplication of money by banks. In a typical fractional-reserve regime, banks held in reserve only a fraction of the total amount they had received in deposits, using the rest to make loans. As a result, banks functioned as instruments of monetary policy by creating money, as illustrated in the following stylized sequence:

the central bank creates money and puts it in circulation → people deposit spare money in banks → banks keep in reserve only a part of the deposits but guarantee the entire amount (fractional reserve) → banks lend the rest of the money deposited → private creation of money occurs through multiplication

Central banks controlled this process by regularly setting the amount of money banks had to keep in reserves (the reserve requirement), thereby limiting how much money banks could create. If too much money was in circulation, the central bank increased the reserve requirements and reduced the pace of money creation by banks. The central bank did the opposite, lowering reserve requirements, if it wanted banks to create more money.[3]

This blunt monetary tool was all but abandoned when inflation-target regimes became widespread in the 1990s.[4] Instead of directly controlling the quantity of reserves, central banks started to target the cost of reserves through open-market operations. Open-market operations allow central banks to influence the volume of reserves available in the banking system by exchanging reserves for securities, either outright or for a short term. The goal is to keep the cost of trading reserves in the interbank market—which represents the basic cost of money in the economy—close to a target set to attain monetary stability, generally understood as low inflation.

And banks trade reserves among themselves to meet their settlement needs in the payments system. Every transfer of funds between clients of different banks must be settled at the central bank using reserves. While doing so, banks hold different positions during the day relative to the other banks, sometimes as senders of reserves and sometimes as receivers. If, at any point of settlements, Bank A has to send reserves to Bank B but does not hold enough reserves, Bank A will have to borrow reserves from another bank and pay interest in return, the “overnight interbank rate.”

The overnight interbank rate, which in the United States is known as the “federal funds rate,” represents the interest rate banks charge when making overnight uncollateralized loans of reserves to each other. Because banks typically do not make loans to their customers at a rate lower than the federal funds rate, this rate acts as a sort of interest-rate floor that influences all other interest rates in the economy.[5]

The demise of central-bank reserves

After the Global Financial Crisis, though, reserves have lost their monetary effectiveness as they became abundant. In countries where the central bank resorted to Quantitative Easing (QE), the central bank made massive purchases of assets, notably government securities, and paid for them using reserves.

But recall that only banks can receive and hold reserves. Therefore, even when the asset sellers were non-banks, all payments the central bank made were intermediated by banks. In this process, banks kept the reserves in their balance sheet as an asset and credited the banking account of the sellers with an equivalent amount, which appeared in the banks’ balance sheet as a liability.

The volume of reserves thus swelled to the point that banks no longer needed to trade reserves in the interbank market either to meet reserve requirements or to settle payments. Before Lehman’s failure in September 2008, reserves in the American banking system had consistently been below $20 billion, with intraday peaks of $150 billion.[6] By October 2014, reserves peaked at $2.8 trillion.[7]

Although reserves have since declined to around $1.4 trillion, they still account for nearly ten times the “normal” pre-crisis level, which should be enough for banks to continue settling payments and for money markets to function without disruption. So, why did the New York Fed have to resume open-market operations amid the recent repo market meltdown? Why do banks seem to want ever more reserves?

Central-bank reserves redux

Reserves became attractive again in the mid-2010s as a result of regulatory requirements, notably liquidity requirements. This time, though, reserves became relevant not for central banks to implement monetary policy, but for banks to comply with prudential regulation. The changing role of reserves led to an unexpected outcome: even with reserves in excess for monetary policy and payments purposes, banks were still demanding reserves to meet new liquidity requirements set by regulators.

One prudential rule in particular may be to blame: the Liquidity Coverage Ratio (LCR) set up as part of the Basel 3 reforms and implemented in countries all over the world since early 2015.[8] The LCR aims to solve a major weakness of the pre-crisis regulatory regime—the lack of a liquidity standard—and is designed to prevent technically solvent banks from failing because most of their assets are illiquid.

To accomplish its goals, the LCR requires banks to hold enough unencumbered high-quality liquid assets (HQLA) that can be used to pay for cash outflows during a hypothetical thirty-day stress event.[9] Cash is the liquid asset par excellence, but other assets that can be converted swiftly into cash in private markets, like government securities, count as HQLA as well.

Cash is considered the most liquid asset because it is issued by the central bank and, save for uncontrolled inflation, has a stable purchasing power. Because reserves are also issued by the central bank, they were immediately treated as a type of HQLA. But when it comes to liquidity, reserves differ from cash in a meaningful way.

As banks can only trade reserves among themselves and with the central bank, banks cannot use reserves to pay their clients or creditors when they want back, in hard currency, their money deposited or invested. Banks would have to ask the central bank to convert reserves into cash before meeting their clients’ and creditors’ demands. But the central bank may not be willing to do so either for monetary reasons (a sudden increase in currency in circulation may cause a spike in inflation) or logistic reasons (the inventory of cash may not be large enough to allow full convertibility immediately).

Reserves can, therefore, be a misleading source of liquidity. But regulators did not take this factor into account when they unconditionally accepted excess reserves as HQLA.

The changing nature of central-bank reserves

Right after the Global Financial Crisis, reserves were only a problem for banks, notably for balance-sheet management. Because assets represent the denominator of capital ratios (bank capital divided by total assets or risk-weighted assets), holding excess reserves pushes down the capital ratio and may force banks to raise more equity or shed other assets.[10]

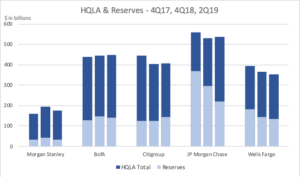

But with the imposition of the LCR and the unconditional acceptance of reserves as HQLA, banks could finally put their excess reserves, even if deposited in a foreign central bank, to good use. The figure below shows that American banks have greatly relied on reserves to meet their HQLA requirement. From the last quarter of 2017 to the second quarter of 2019, reserves represented, on average, more than 30% of the HQLA banks were required to maintain.

The one outlier is Morgan Stanley, with reserves amounting to about 20% of HQLA. The variation is likely due to the firm’s business profile, which is more oriented to holding and trading securities. As many of these securities count toward the required level of HQLA, Morgan Stanley can use a smaller volume of reserves to that end.

For JP Morgan Chase, in contrast, reserves were above 60% of HQLA at the end of 2017, but have fallen to around 40% in June 2019—still the highest volume among the four big retail banks. Despite the marked reduction, this percentage means that, in absolute numbers, JP Morgan Chase needs to leave $220 billion of reserves parked daily at the central bank for regulatory purposes.

As a result of this change in perspective caused by the LCR implementation in early 2015, the previously dormant interbank market for reserves started to bloom again. Banks now had a regulatory incentive to chase and accumulate reserves.[11]

However, the market for reserves would change once more two years later, when the Fed launched its “policy normalization” regime to reduce the size of its balance sheet. Beginning in October 2017, the Fed started to “gradually reduce [its] securities holdings by decreasing its reinvestment of the principal payments it receives from securities held in the System Open Market Account.”[12]

By reducing its securities holdings, the Fed also reduced the volume of reserves available to the banking system. Operationally, the Fed would perform a kind of QE in reverse, selling back to the market the securities it had purchased—or just letting these securities mature in its portfolio—and receiving reserves in exchange as payment. As reserves are an asset for banks, but a liability for the central bank, the amount of reserves transferred from banks to the Fed are subtracted from the total amount of reserves on the liabilities side of the Fed’s balance sheet. Since early 2018, reserves in the United States have fallen by close to $800 billion (from $2.2 to 1.4 trillion).[13]

Thus, right after banks discovered a new use for reserves, the Fed decided to shrink its balance sheet and reduce the amount of excess reserves available. The monetary-policy goals of the Fed and the regulatory interest of banks towards reserves diverged, with potentially severe consequences for monetary and financial stability.

But how did these misaligned interests end up affecting the repo market? Because reserves are now serving conflicting purposes.

Central-bank reserves and the repo disaster

On the one hand, banks need reserves to settle transactions in the payments system during the day based on the volume of funds sent and received by their clients. The more funds that flow between clients, the more reserves required from banks to settle transactions within the central bank. And the flow of funds increases when banks provide market participants with liquidity—for example, by granting short-term loans in the repo market.

On the other hand, banks need to continually hold reserves at a certain level to comply with liquidity requirements since, for big banks, the LCR is calculated every business day. Sure, a drop at the daily level of reserves could be counterbalanced by an increase at the level of other liquid assets, like government securities. But banks face a cost to perform this treasury-management operation. As reserves have been offering reasonable returns, at times higher than the yield from government securities, banks may not be willing to give reserves up.

The problem appears more vividly on days when market participants require unusual levels of liquidity because of immediate needs. In the recent repo market turmoil, it seems that the significant demand for liquidity happened when the need to absorb new securities auctioned by the Treasury coincided with the need to make corporate-tax payments.[14]

As market players cried out for additional liquidity, banks had two options. One, banks could provide the required liquidity, face increasing flows of funds, and spend more reserves at settlement time, trying to compensate for the lower level of reserves later to meet the LCR. Or two, banks could ignore the liquidity requests, keep the flow of funds stable in the payments system, and hold on to reserves to comply with the liquidity requirements without incurring extra costs.

The evidence suggests that banks chose option two, and overnight repo rates spiked as a result. It was only when the New York Fed offered reserves in the interbank market that banks decided to meet the increasing demand for liquidity in the repo market—and short-term interest rates fell to more acceptable levels.

Conclusion

The recent repo turmoil does not seem to be a sign that a financial crisis is looming or that the Fed’s monetary-policy framework is flawed. Instead, it may well be an alarm bell sounding that it is time to rethink some prudential rules. Regulators may want to consider phasing out the use of central-bank reserves to meet regulatory requirements, which should entail a recalibration of regulatory-minimum ratios for liquidity standards.[15] Failing to do so may end up undermining the very purpose of these rules: to make the financial system more resilient.

Marcelo M. Prates is a lawyer at the Central Bank of Brazil and a double graduate of Duke University School of Law (LL.M. 2015, S.J.D. 2018). The views and opinions expressed here are his and do not reflect the position or policy of any of the institutions with which he is affiliated. For comments, please contact marcelo.prates@bcb.gov.br.

[1] See Federal Reserve Bank of New York (n.d.). Repurchase Agreement Operational Details, Retrieved September 26, 2019.

[2] Some useful summaries of the repo turmoil and the reactions that followed were written by Izabella Kaminska, A story about a liquidity regime shift (September 20, 2019), and by David Beckworth, The Repo Man Cometh (September 23, 2019). It is also valuable to compare the views of two former Fed officials on the issue. The former President of the New York Fed, Bill Dudley, seemed less worried about the repo turmoil, stating that “the fed can handle the repo market” (Bloomberg Opinion, September 20, 2019). Narayana Kocherlakota, the former President of the Minneapolis Fed, looked more concerned in turn (Bloomberg Opinion, September 25, 2019).

[3] This view that banks are “intermediaries of loanable funds” has been challenged more recently, since, in the context of a fiat-money regime, banks may have the power to create money through lending, with no need to rely on previous deposits. See, for instance, Hockett, R. & Omarova, S. (2017). The finance franchise. Cornell Law Review, 102(5), 1143-1218; and Ricks, M. (2016). The money problem: Rethinking financial regulation. Chicago, IL: The University of Chicago Press (pp. 52-62).

[4] Reserve requirements are currently nonexistent in England and irrelevant in the United States and the Eurozone, while still important in Brazil. For a comparative overview of how reserve requirements are used in different countries, see Gray, S. (2011). Central bank balances and reserve requirements (IMF Working Paper No. 11/36).

[5] See, for example, Board of Governors of the Federal Reserve System. (2016). The Federal Reserve System: Purposes & functions (10th ed.). Washington, DC: Author; and McLeay, M., Radia, A., & Thomas, R. (2014). Money creation in the modern economy. Bank of England Quarterly Bulletin, 54(1), 14-27.

[6] Intraday peaks usually resulted from “daylight overdrafts,” which were provided to banks by the Fed to increase liquidity and facilitate payments settlement. See JP Koning (2017), Why the American taxpayer might prefer a large Fed balance sheet, and Peter Stella (2019) on debt, safe assets, and central bank operations (interview with David Beckworth).

[7] See Board of Governors of the Federal Reserve System. (n.d.). [Graphic data]. Credit and liquidity programs and the balance sheet – Recent balance sheet trends, Retrieved September 27, 2019.

[8] About the LCR, see Bank for International Settlements. (2018, April 30). Liquidity Coverage Ratio (LCR) – Executive Summary. For an overview of how the standard was implemented in the United States, see Davis Polk. (2014, September 23). U.S. Basel III Liquidity Coverage Ratio Final Rule

[9] The LCR is summarized in this formula: “Stock of high-quality liquid assets (HQLA)/Total net cash outflows over the next 30 calendar days ≥ 100%.”

[10] For more on how excess reserves can complicate banks’ balance-sheet management in the longer run, see Peter Stella. (2015, December 31). Exiting well [Blog post].

[11] For a detailed explanation of “how specific liquidity and capital regulations treat liquidity holdings favourably, creating incentives for banks to hold and not to distribute excess liquidity,” see Baldo et al. (2017). The distribution of excess liquidity in the euro area (ECB Working Paper No. 200). Also exploring the connection between regulatory requirements and reserves accumulation, see Logan, L. (2019, April 17). Observations on implementing monetary policy in an ample-reserves regime (Remarks before the Money Marketeers of New York University, New York City).

[12] Board of Governors of the Federal Reserve System. (2017, June 14). Press release. FOMC issues addendum to the Policy Normalization Principles and Plans.

[13] See Board of Governors of the Federal Reserve System. (n.d.). [Graphic data]. Credit and liquidity programs and the balance sheet – Recent balance sheet trends. Retrieved September 27, 2019.

[14] See Rennison, J. & Greeley, B. (2019, September 17). Why is the Federal Reserve pouring money into the financial system? Financial Times.

[15] Another possible solution comes from David Andolfatto and Jane Ihrig (2019, March 6). Why the Fed should create a standing repo facility. On the Economy Blog. The authors propose that the Fed should create a “standing repo facility” “that would permit banks to convert Treasuries to reserves on demand at an administered rate.” As a consequence, banks could have an incentive to hold government securities instead of reserves to meet liquidity requirements, allowing the Fed to reduce the volume of reserves available to the banking system without causing disruptions.